Let’s be honest. The stock market yesterday was ugly – and painful.

The Dow Jones dropped about 600 points. The S&P 500 shed 2%. The Nasdaq dropped nearly 3%. Everything – save a few oil and gas stocks – closed in the red. The stocks we follow – hypergrowth stocks, innovation stocks, growth stocks, tech stocks, etc. – got crushed.

So… why the huge sell-off?

Our old enemy: The 10-year Treasury yield.

Yields started moving higher last week after the Fed moved up rate hike projections and announced its intentions to start its taper by the end of the year. In anticipation of tighter monetary policy, bond market investors have hit the “sell” button, and yields have spiked.

At first, the stock market didn’t react to the move higher in yields. After all, the 10-year simply moved from 1.3% to 1.4%. It was just recouping some lost ground.

But the ascent in yields has accelerated over the past three trading sessions. Now, the 10-year is up around 1.55% – it’s highest level since June. The stock market is paying attention now. In fact, you could say that the stock market is finally throwing its so-called “taper tantrum” – a term for when the stock market throws a fit in response to yields moving higher too quickly, as such a sharp increase in yields puts increased pressure on equity valuations and weighs on market prices.

But, while the market is throwing a taper tantrum, we’re sitting calmly on the sidelines, and remain steadfastly bullish on our stocks.

Why? Because of math.

The fact of the matter is that everyone out there has an opinion on where yields are going to go, but statistically speaking, economic projections have proven to be barely batter than random. Seriously. Multiple studies have found that economic forecasts are no better than a random walk.

So, our advice to you is to stop listening to those talking heads, and instead, start looking at the numbers here.

The numbers tell a very clear story that the 10-year Treasury yield should trade around 2% for the next few years, and that at those levels, the stock market is actually undervalued.

Here’s the story…

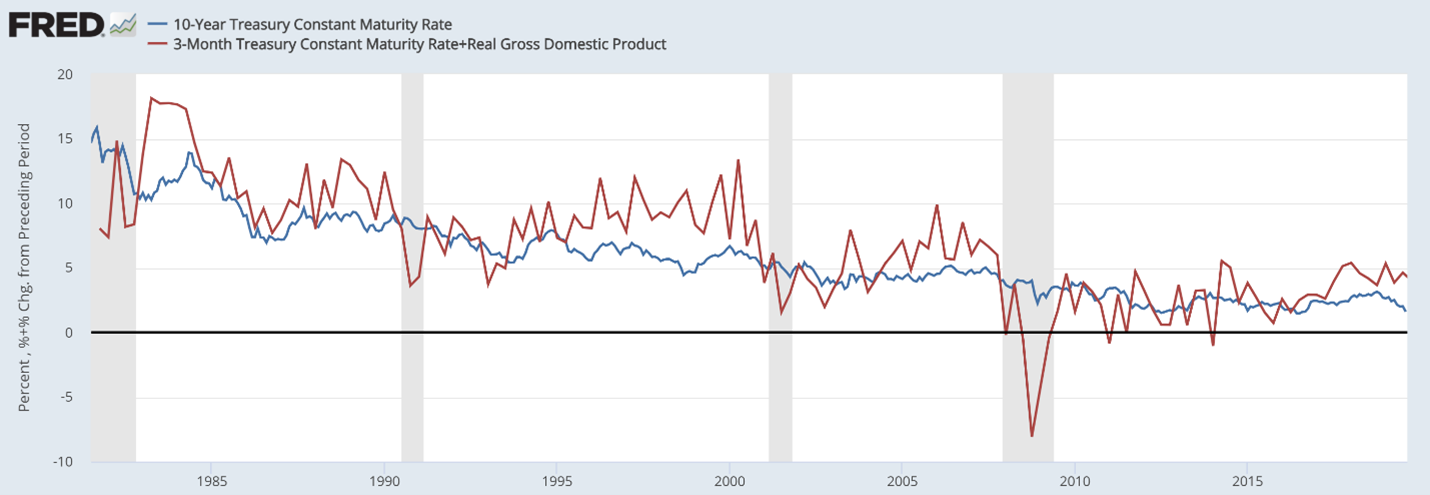

Historically speaking, the 10-year Treasury yield has very closely tracked the sum of the 3-month yield and real GDP growth since 1980. That makes sense. After all, the 3-month tracks the Fed Funds Effective Rate (which is the true risk-free rate), so buyers of 10-year government bonds have historically demanded a yield equal to the true risk-free yield plus the pace of economic growth. Makes complete sense.

The 3-month yield is not going anywhere anytime soon.

As stated earlier, this yield tracks the Fed Funds rate, and we think that stays at zero for the foreseeable future, despite the Fed projecting a rate hike in 2022. That’s because we believe that the secular deflationary force of technology – which makes everything more efficient and less expensive – will continue to depress inflation in the long run, much as it has over the past 30 years. Thus, we see inflation falling below the Fed’s inflation target of “over 2%” in 2022 and beyond, and therefore, we believe the Fed will keep rates at zero in 2022 and 2023.

To that extent, the 3-month yield should stay around zero for the foreseeable future.

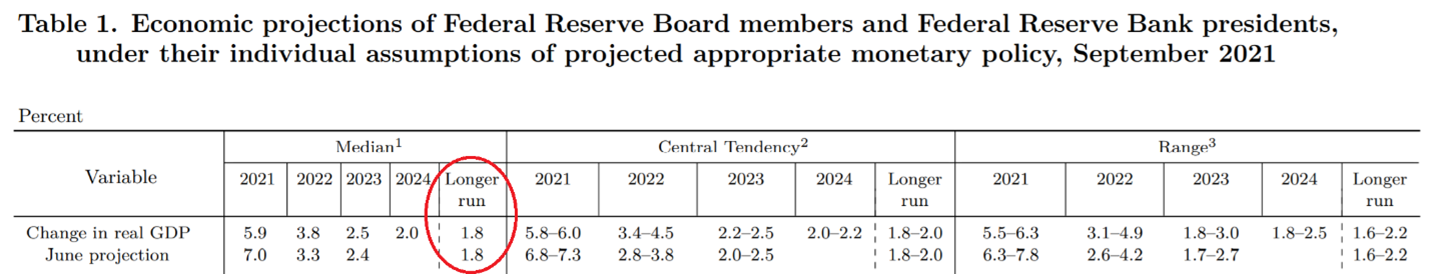

Meanwhile, the Fed just released its latest summary of economic projections, and while they’re targeting for 5.9% real GDP growth in 2021 and 3.8% in 2023, the longer run real GDP growth forecasts are anchored around 1.8%. We think that number will look more like 2%, and therefore, believe the appropriate number to use in our calculation is 2% for normalized real GDP growth.

Let’s revisit the formula…

10-Year Treasury Yield = 3-Month Treasury Yield + Real GDP Growth.

10-Year Treasury Yield = 0% + 2% = 2%.

Therefore, we think the fundamentally “fair” yield on 10-year Treasuries is about 2% today, and will remain at 2% in 2022 and beyond, or so long as real GDP growth remains anchored around 2% and the Fed keeps rates at zero.

We’re sitting at 1.55% today, so there really isn’t that much more room to run when you consider that 2% target is a 2022 and beyond target.

More importantly, if the 10-year Treasury yield does trend towards and then stabilize around 2% in 2022, the stock market is fundamentally undervalued – not overvalued.

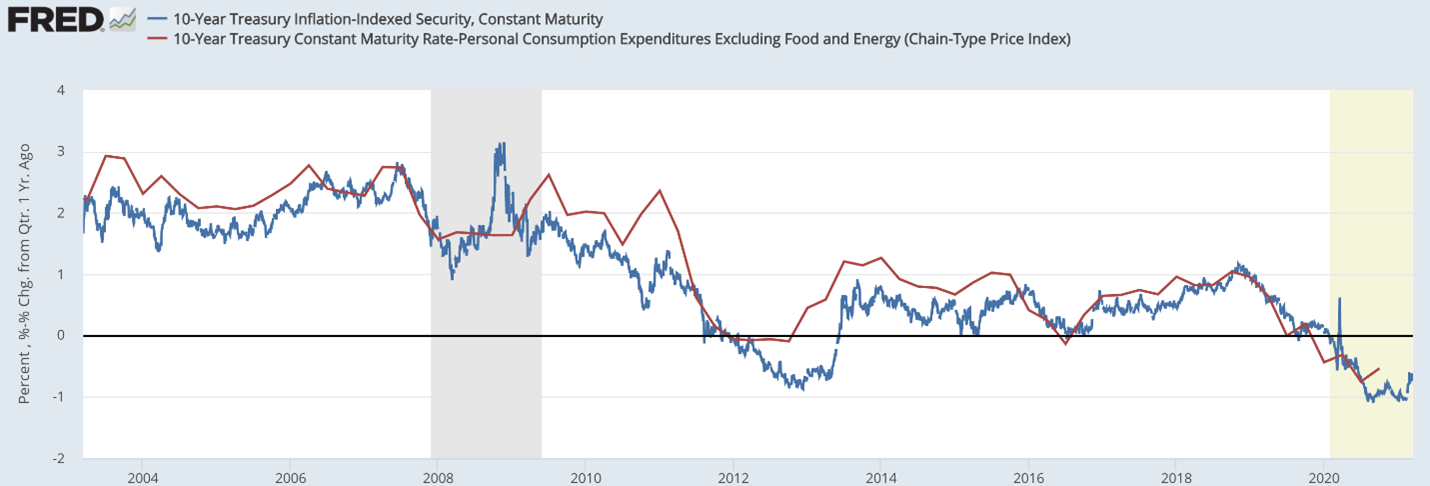

To understand why, we have to look at 10-year Treasury Inflation-Protected Securities, or TIPS – which is just the yield on 10-year Treasury notes once you back out inflation expectations – and the real equity risk premium – which is the premium investors demand to buy risky stocks over risk-free bonds.

TIPS is easy enough to calculate. It’s basically just the 10-year yield less inflation. We believe inflation will hover back to below 2%, for a fair TIPS yield of about 0%.

The real equity risk premium (ERP) is also easy to calculate. It’s just the spread between the TIPS yield and the S&P 500 earnings yield – which is one divided the S&P 500 price-to-earnings ratio. Our numerical analysis suggests that this spread has average around 450 basis points over the past 20 years. Thus:

0% TIPS yield + 4.5% real ERP = 4.5% fair S&P trailing earnings yield.

1 / 4.5% S&P 500 trailing earnings yield = 22.2 fair trailing P/E multiple for the S&P 500.

Now… let’s look at earnings estimates.

Full story on InvestorPlace.com