The biggest “tech retirement” stock of the DECADE

Sponsored

What if you could go back to 1997 and invest in Amazon before it became a global retail behemoth? Or transport back to '87 and buy into Apple? Better yet, what would happen if you spun Facebook, Netflix, YouTube, Apple AND Amazon all into one stock… AND you had the chance to get in early while shares were still dirt cheap? Check it out: It's not a fantasy, and you don't need a time machine. Because I've uncovered one stock that is on pace to best ALL FIVE of those tech giants… And right now you've got a short window of time to get in early. I'm ready to tell you all about the BIGGEST “tech retirement” stock of the decade – click here right now…

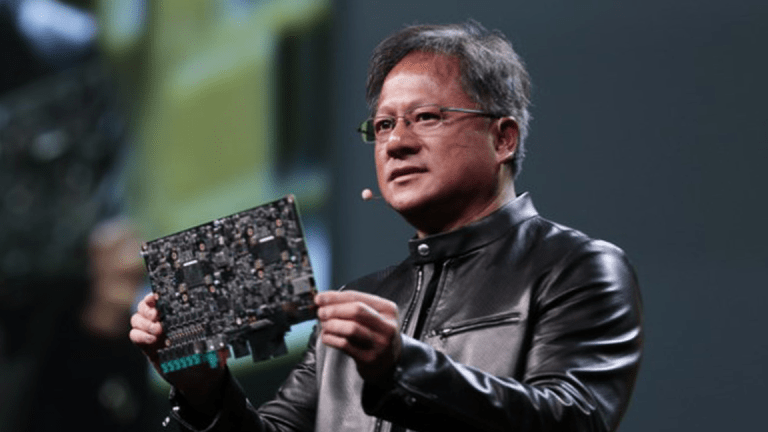

High-end chip maker Nvidia (NVDA) has smashed expectations year over year, with annualized revenue growth of 60% since 2021. With yearly releases of improved graphics processing units (GPUs) for both gaming and cloud computing, the company has been able to continuously offer the best GPU hardware on the market. This strategy has led the company's stock on a meteoric rise. But what happens if the growth stops?

At Friday's prices, Nvidia's price-to-earnings ratio is around 80, more than double the valuation of the tech sector overall. That means if growth slows or profitability wanes, its stock price could get slashed. In fact, competition in the high-end GPU market could end up challenging Nvidia's revenue growth.

But growth-minded investors hoping the upward trends that make Nvidia so valuable can take heart. The company's new focus on its data center product lines could be the answer.

The threat to Nvidia's GPU dominance

While Nvidia is known for high-performance graphics processing units, GPUs come in many types. But in the case of data center GPUs, Nvidia controls an astounding 98% of the market, according to industry research by Wells Fargo. This immense advantage comes from the company's early leg up in the technology as its inventor and a current lack of serious competition. However, nothing lasts forever in the tech sector, as the constant GPU competition has bred innovation among Nvidia's competitors — namely Advanced Micro Devices.

Since announcing its new Instinct MI300 GPU line-up, AMD has been turning heads as a potential alternative to Nvidia's dominance. While it's impossible to predict how the AMD product line will perform in real-world data center applications, its release will ultimately put a dent in Nvidia's GPU revenue.

Despite Nvidia's marginally better performance across GPU offerings, its current pricing puts it at risk of AMD undercutting it in the data center GPU realm as well. Furthermore, as other GPU suppliers catch up in the market, the demand that Nvidia currently takes advantage of to generously price its products will likely saturate.

The significance of the data center platform

Nvidia touts its data center platform as “the world's most adopted accelerated computing solution, deployed by the largest supercomputing centers and enterprises,” yet the real value of this platform cannot be overstated. With cloud computing services becoming relevant to nearly every existing business, demand for Nvidia's data center GPUs resulted in $18.4 billion in revenue for the product line in 2023. This represents a 409% increase from 2022, and that revenue stream will only continue to increase as demand for artificial intelligence (AI) data processing expands in 2024.

Yet one real future possibility for Nvidia may not be its hardware sales from data center GPUs, but rather its long-term service revenue. By switching to service-based business models, Nvidia could hedge against the eventual saturation or decrease in demand for the GPU hardware market.

The decision to shift from hardware to software is one we've seen other tech giants make, both in the past and present. One such example is Microsoft, which started its tech journey as a personal computer company but eventually focused on software and services like Windows and Azure. Even Apple's falling hardware sales are currently supplemented by its more profitable software services, like Apple Music and the App Store.

A glimpse into Nvidia's service-based future

A current example of how Nvidia may shift to more service-based revenues is its DGX Cloud, which offers custom AI training solutions. The service essentially intends to surpass the limitations of traditional AI infrastructures. Nvidia aims to achieve this by doing away with the current enterprise trends of driving insights from endless sources of unstructured data.

Though traditional cloud computing currently serves the purpose of supporting AI processing, Nvidia sees its limitations and markets DGX Cloud as a far more efficient and cost-effective solution. This mirrors how Nvidia released CUDA as a free-to-use software development tool, thus expanding applications of its general processing GPUs. As such, DGX Cloud extends the same expertise to AI training via cloud computing.

Dubbing it a “serverless AI factory,” Nvidia intends to onboard customer-side developers, giving them the capability to rapidly experiment with remote GPU resources instead of having to try to fit procured hardware to the current needs. In this model, Nvidia handles all of the hardware costs resembling a hardware-as-a-service business model and enables its customers to focus on software iteration.

Is a service-based Nvidia a buy today?

For investors, the days of gargantuan portfolio growth on the back of Nvidia's stock are in the past. The 51,000% returns investors have seen over the past 20 years are mathematically unfeasible for a company with a $2.4 trillion market cap. But that doesn't mean Nvidia is no longer worth investing in. Should the company manage to keep growth rates high, it will only continue to increase in value. Whether or not it can successfully bolster its growth with hardware and software services remains to be seen, but the current market growth in cloud computing does signal increasing revenue opportunities for Nvidia in 2024.

Furthermore, speculation around a potential stock split could make Nvidia more accessible to retail investors uncomfortable with a share price around $950. Thanks to tremendously innovative leadership and commitment to expanding news services and business models, Nvidia will likely remain a stable choice for investors looking to add it to a long-term growth portfolio.

BREAKING: Bill Gates Says It's “Worth 10 Microsofts”

Sponsored

Have you jumped on the AI gravy train yet? So far this year:

- Microsoft is up 36%…

- Amazon is up 62%…

- Apple is up 44%…

- Google (Alphabet) is up nearly 50%…

- And Nvidia is up a whopping 203%.

Speaking of Microsoft… Fortune reports that former CEO Bill Gates is got $2 billion richer after Microsoft mentioned AI 50 times on its earnings call. But here's a surprise. I believe the biggest winner of all could be what I call the $3 AI Wonder Stock. Incredibly, this company is still a minnow in the ocean… With a market cap less than 1/1,000th that of Microsoft. It's your chance to join the big boys before AI gets absolutely massive. The best way to do it? Click here to view my Free Presentation, and get your hands on the $3 AI Wonder Stock that could make you super-rich (plus a whole lot more)… Don't delay. This is a fast-moving opportunity. WATCH MY BULLETIN NOW.