The U.S. stock market has been shaky with major indexes gaining and losing steam as events unfolded one after another. Year to date, the NYSE has lost 3.3%, the NASDAQ is down 14%, and the S&P 500 has declined 7%.

Respite from the horrors of the pandemic has been welcoming, but instances of the rapid increase in infection cases in China have forced investors to remain cautious in their approach.

Further, the ongoing Ukraine-Russia war and its impact on the global economy, the supply-chain bottlenecks, labor and high costs problems, inflation (with the U.S. inflation rate accelerating to 8.5% in March), and the tightening of monetary policy by the federal agency have unnerved investors.

In its World Economic Outlook report published this month, the International Monetary Fund expressed concern about the health of the global economy. The agency has lowered the global economy’s growth forecast by 80 basis points (bps) to 3.6% for 2022, and by 20 bps to 3.6% for 2023.

The U.S. economy is projected to grow 3.7% in 2022 and 2.3% in 2023, reflecting a 30 bps fall for both the years from the January forecast.

In such difficult times, investors (according to their risk appetite) can leverage from gaining exposure to defensive stocks. Such options usually keep investors happy with dividend incomes, solid growth prospects, and low reaction to market volatility (as measured by beta).

Utilities and real estate sectors are the widely accepted defensive sectors in the U.S. So far in April, the S&P 500 Utilities index has yielded a return of 2.33%, and the S&P 500 Real Estate index has grown 2.73%. On the contrary, the S&P 500 index has witnessed a decline of 1.51%.

Utilities are Keeping Spirits Charged

The sector is primarily engaged in the exploration and development of oil & natural gas, refining, and providing basic facilities (including water, sewage, and electricity) to end-users across the United States.

Growth prospects in the sector are fueled by healthy demand, constant efforts to boost production capacity and upgrade infrastructure, and focus on providing cleaner sources (like wind, solar and nuclear) of energy.

As of March 31, 2022, the projected P/E multiple for the S&P 500 Utilities index was 21.72, and its dividend yield was 2.83%. The index had a total market capitalization (mean) of approximately $36.2 billion.

Two defensive stocks from the utilities sector worth considering are American Electric Power Company, Inc. (NASDAQ: AEP) and NiSource Inc. (NYSE: NI).

American Electric Power Company

This $51.7-billion worth public utility holding company engages in all phases of electricity generation, transmission, and distribution. Year to date, shares of American Electric have gained 15.6%.

This stock presently has a dividend yield of 2.98% and a payout ratio of 64.09%. Its quarterly dividend rate is $0.78 per share. The beta is low at 0.36.

The company has a Strong Buy consensus rating based on nine Buys and two Holds. AEP’s average price forecast of $105.60 suggests 3.09% upside potential from current levels. The stock scores an 8 out of 10 on TipRanks’ Smart Score rating system.

NiSource

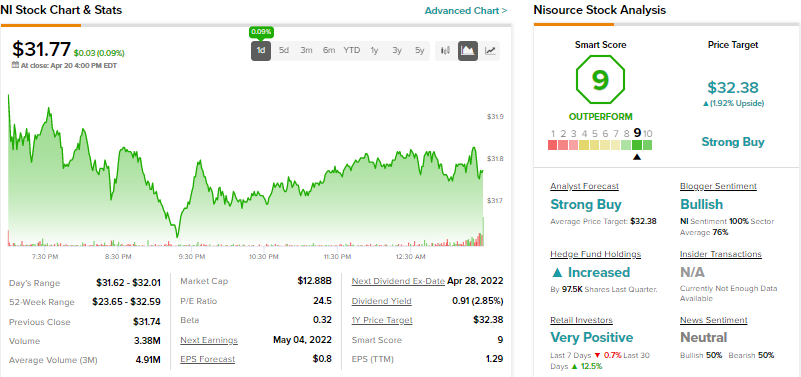

This company engages in providing electricity, natural gas, and other services and products. It has a market capitalization of $12.9 billion. Shares of the company have advanced 15.4% so far this year.

The dividend yield of this energy solutions provider is 2.85% and the payout ratio is 63.64%. The quarterly dividend rate is presently pegged at $0.23 per share. Sensitivity to market volatility (beta) is 0.32.

The company’s consensus rating is a Strong Buy based on six Buys and two Holds. NiSource’s average price target of $32.38 mirrors 1.92% upside potential from current levels. It scores a 9 out of 10 on TipRanks.

Real Estate is Offering Ample Room for Growth

The sector, as the name suggests, deals with real properties including land, buildings, and homes. The health of real estate companies mirrors the prospects of the country’s commercial, industrial, residential, and other markets. The desire to own residential and commercial properties, the government’s pro-growth measures, easy search options through online-search engines, and technological advancements are prime driving forces of this sector.

The S&P 500 Real Estate index had a P/E (projected) multiple of 45.72 and a dividend yield of 2.52% as of March 31, 2022. The mean market capitalization of this index is $36.7 billion.

Two defensive stocks from the real estate sector are Crown Castle International Corp. (NYSE: CCI) and American Homes 4 Rent, L.P. (NYSE: AMH).

Crown Castle International

This real estate investment trust (REIT) company has a market capitalization of $84 billion. Shares of the company have declined 6.7% year-to-date.

Crown Castle has a dividend yield of 2.91% and a payout ratio of 209.74%. Its quarterly dividend rate is $1.47 per share. It has a beta of 0.56.

CCI has a Strong Buy consensus rating based on seven Buys. Crown Castle’s average price forecast of $203.86 mirrors 5.15% upside from current levels. The company scores a ‘Perfect 10’ on TipRanks.

American Homes

The company’s market capitalization stands at $15 billion. Shares of American Homes have declined only 0.4% so far this year.

The company has a dividend yield of 1.16% and a payout ratio of 120%. The quarterly dividend rate is $0.18 per share. Beta is low at 0.61.

This REIT has a Moderate Buy consensus rating based on seven Buys and three Holds. American Homes’ average price target of $45.22 mirrors 5.16% upside potential from current levels. The company scores a ‘Perfect 10’ on TipRanks.

Conclusion

Defensive stocks usually prove to be smart investment choices for investors in turbulent times. The aforementioned companies have all the ingredients, including solid fundamentals and promising returns and low betas, to cushion investments in a volatile market.

Where to invest $100 right now?

Our award-winning analyst team just revealed what they believe are the 5 top under-the-radar stocks for investors to buy right now…

Originally published on TipRanks.com

Read full Disclaimer & Disclosure